Camila Murata is the President and principal broker of Luxury Real Estate Group, a rapid growing brokerage in Florida that serves a diverse clientele with all real estate related services.

Camila launched her real estate career in Florida in 2012 and shortly thereafter became a broker. She has now a longtime record of guiding national and international buyers who are relocating in South Florida or who are looking for investment opportunities. With honesty, dedication, tenacity and local knowledge she is the real estate broker all past clients continue to consult with and recommend.

Camila is an Accredited Buyer’s Representative (ABR®), Certified Military Relocation Professional and a Certified International Property Specialist (CIPS) with experience and recognition.

Camila's personal belief that everyone should have the opportunity to home-ownership has led her to further promote programs and incentives for people of all backgrounds to access home-ownership opportunities. Her unique life experience and thrive to succeed gives her a special connection to home buyers.

Offering special incentives to buyers and sellers who are community heroes like teachers, military servicemen and police members, Camila ensures that she gives back for what she has benefited from as a resident of Florida. Camila appreciates the connections she has made with her community either through her work or through the activities of her two children.

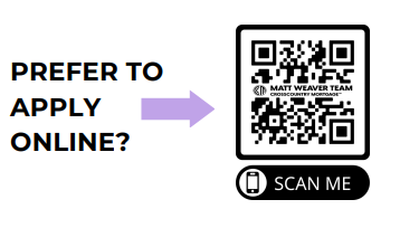

2. MORTGAGE APPLICATION

2. MORTGAGE APPLICATION 3. INSPECTION

3. INSPECTION 9. FINAL WALKTHROUGH

9. FINAL WALKTHROUGH